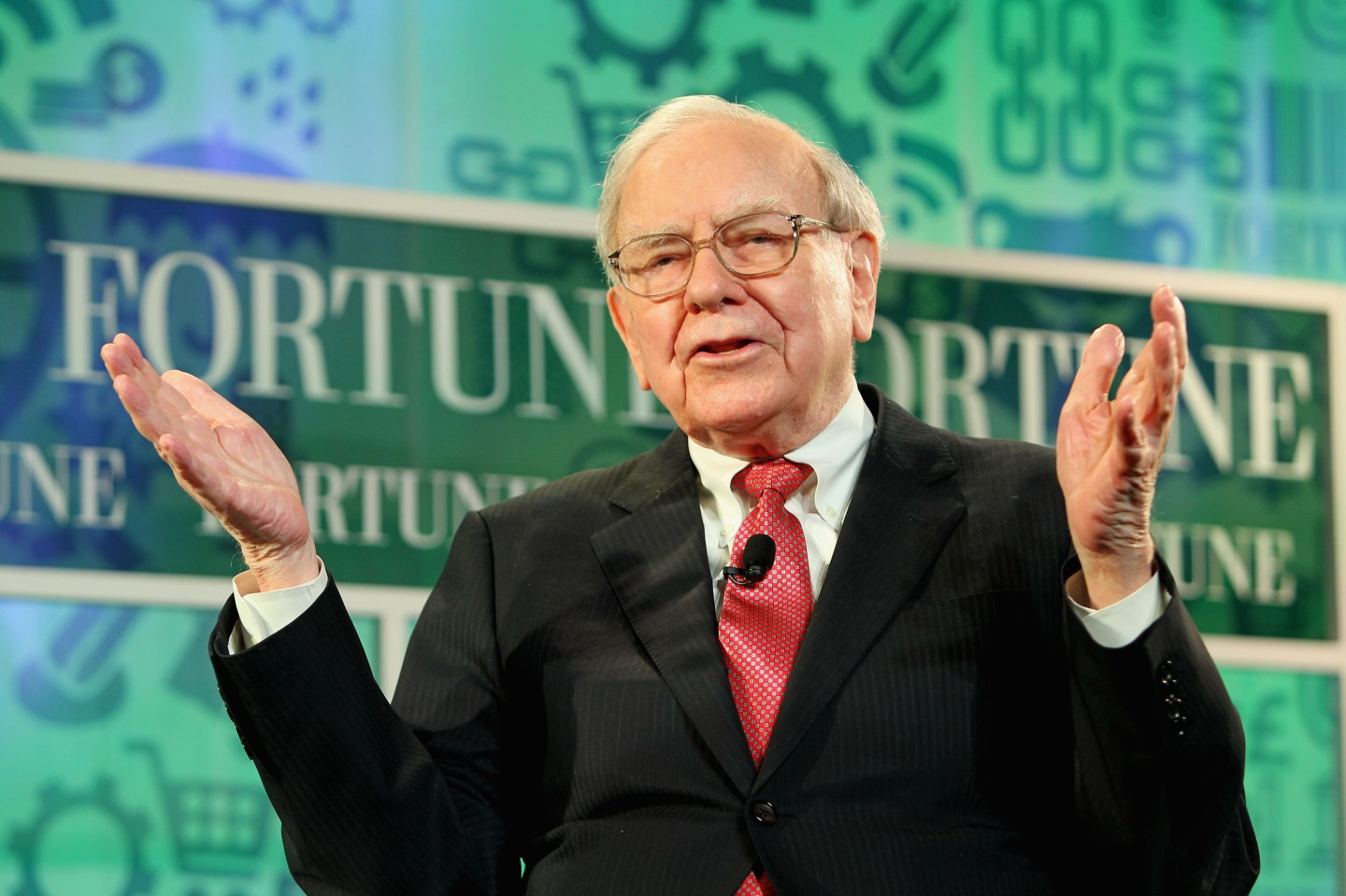

Maybe its the Warren Buffett effect.

In the weeks following its earnings report in April, Apple (AAPL) looked like it was in a tough spot. Shares of the tech giant fell 13.4% between late April and May 12, after Apple reported that sales had dropped for the first time in 13 years. Shares rebounded slightly, before Warren Buffett, the Oracle of Omaha, disclosed his company’s $1.02 billion stake in the company on May 16.

Since then, shares of Apple have soared 9%—finally breaching the $100 mark, its highest point in a month. Buffett tends to have that effect on stocks—for example, when the company disclosed a stake in Kinder Morgan (KMI) in February, shares shot up 11%.

Apple’s rise in the past few weeks is no doubt partially the cause of Berkshire Hathaway’s disclosure (granted, the stock was decided by Buffett’s deputies rather than himself, as was Kinder Morgan), but Apple has also given some fairly bullish news.

Apple seemingly upped its production targets—which was a good sign for the company’s iPhone 7 sales. The tech company asked producers to make 72 million to 78 million new iPhone 7 by the end of the year—its highest production target in about two years, according to Barrons. Analysts had expected just 65 million iPhone 7s for the year.

In the more puzzling category, CNBC’s Jon Najarian reported on Thursday that 7.5 million shares of Apple were ordered at $99.16 per share on the Midwest Stock Exchange. Another five million shares was also placed at $99.16—likely by the same person or entity.

Markets however seemed little moved by the bad news during the past week. Investors have been hoping that the massive potential market in India might make up for Apple’s stalled consumer base in China. But Indian officials said earlier this week that Apple would have to produce at least 30% of its material locally in order to open multiple stores in India. Apple currently builds the majority of its products in China.

And, it should be noted, that when Berkshire Hathaway first disclosed his IBM stake(IBM) in 2011—Buffett’s first tech stock—shares actually fell .96% on the day, and 19.4% to now.

Despite being repeatedly asked if he regretted the decision to buy IBM, Buffett has held strong on his principles of long-term investing.

What matters, Buffett noted, was where the stock would be trading 10 years from now.