In 2010, a Minnesotan named Erwin Lingitz was arrested in a Supervalu grocery store after spending an excessive amount of time at the deli counter. In the words of a Supervalu spokesperson, Lingitz had violated “societal norms and common customer understanding regarding free-sample practices.” While the charges were later dropped, the evidence remains incriminating: After a search, Lingitz was found to have stored in his pockets about a dozen soy sauce packets and “1.46 pounds of summer sausage and beef stick samples.”

Lingitz may have gotten carried away, but his impulse is more or less universal. People love free, people love food, and thus, people love free food. Retailers, too, have their own reasons to love sampling, from the financial (samples have boosted sales in some cases by as much as 2,000 percent) to the behavioral (they can sway people to habitually buy things that they never used to purchase).

There’s no brand that’s as strongly associated with free samples as Costco. People have been known to tour the sample tables at Costco stores for a free lunch, acquired piecemeal. There are even personal-finance and food bloggers who’ve encouraged the practice. Costco knows that sampling, if done right, can convince people that its stores are fun places to be. (Penn Jillette, of the magic act Penn & Teller, has on more than one occasion taken a woman on a date at a Costco warehouse.)

“When we compare it to other in-store mediums … in-store product demonstration has the highest [sales] lift,” says Giovanni DeMeo of the product-demonstration company Interactions, a department of which handles Costco’s samples. That department is Club Demonstration Services, and it—not Costco—staffs the sample tables.

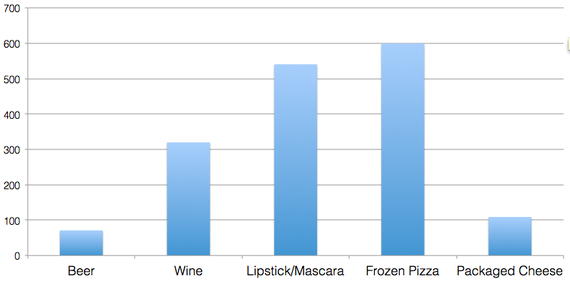

While DeMeo insists that the short-term spike in sales isn’t the only effect of product sampling that matters—it's great for making customers loyal to stores and brands over longer periods of time—the figures are impressive. In the past year, Interactions’ beer samples at many national retailers on average boosted sales by 71 percent, and its samples of frozen pizza increased sales by 600 percent. (These figures are in line with the few others that are publicly available.)

It’s true that free samples help consumers learn more about products, and that they make retail environments more appealing. But samples are operating on a more subconscious level as well. “Reciprocity is a very, very strong instinct,” says Dan Ariely, a behavioral economist at Duke University. “If somebody does something for you”—such as giving you a quarter of a ravioli on a piece of wax paper—“you really feel a rather surprisingly strong obligation to do something back for them.”

Ariely adds that free samples can make forgotten cravings become more salient. “What samples do is they give you a particular desire for something,” he says. “If I gave you a tiny bit of chocolate, all of a sudden it would remind you about the exact taste of chocolate and would increase your craving.”

Plenty of marketing research has been done on the fruits of retail strategies like couponing and loyalty cards, but the literature on free samples is relatively sparse. One narrowly applicable study from 1978, for example, found that samples were more likely to cause obese customers to purchase something than customers of normal weight.

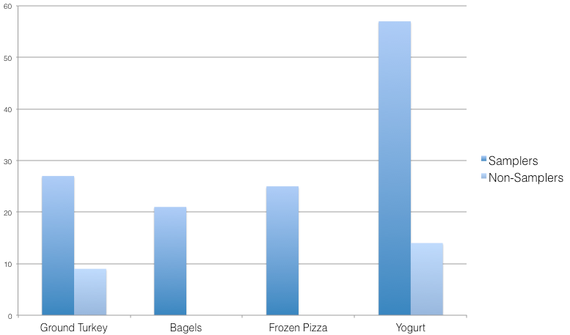

A 2011 study in the British Food Journal sought to illuminate the lucrative but uncharted (at least in the academic literature) practice of putting out free samples. The researchers surveyed shoppers at a grocery store on six different weekends, and their findings color in a detailed picture of the mechanisms that underlie free samples.

For starters, about three-quarters of people surveyed took a free sample when offered one. And those who did take a sample were more likely to have taken other samples than those who didn’t—which suggests that people are driven to samples more by their dispositions than by their perceptions of a product’s relevance to them. Interestingly, people who took samples were less likely than non-samplers to have graduated from college.

This 2011 study also highlighted the importance of making sure a demo table doesn’t go unattended. “Samplers with a heightened awareness of the presence of others at the sampling station may feel a level of social ‘pressure’ to make a post-sample purchase,” the researchers wrote. Shoppers might feel they owe the demonstrator something—reinforcing Ariely’s point about reciprocity—but they also felt the need to right a perceived karmic imbalance when they were accompanied at the table only by other shoppers.

All of this makes for a potent combination for Costco: People come to their stores to some extent because it’s fun, and then a variety of psychological mechanisms kick in, compelling them to buy more products over a longer period of time. (Costco declined multiple requests for comment.)

Costco’s prepared-food departments also appear, to some extent, to be designed with the purpose of making the stores destinations. In 1985, Costco opened its first in-store hot-dog cart, and the price of a hot-dog-and-soda combo has remained $1.50 since then. Even with prices like this, the food courts still manage to make a profit, and in 2009, Costco sold 90 million hot dogs.

Now, the stores serve pizza as well, and—given that there were 468 U.S. Costco locations at last count—if it weren’t considered a retailer, Costco would be number 11 on the list of the biggest pizzerias in the U.S., just ahead of Round Table. And calling it a pizzeria might not be too much of a stretch: Families often go to Costco warehouses for a cheap lunch, and sometimes don’t do any shopping. “The more positive experiences people have with Costco, the more likely they are, presumably, to shop at Costco, to bring up Costco in conversation,” says Art Carden, a professor of economics at Samford University.

Costco's samples and food courts get customers in the door, but it appears that their reliance on product-demonstration contractors allows them to help the bottom line in some less savory ways. The company is known for its generous benefits package—health care, vision, dental, and 401(k)s for just about everyone—but employees of Club Demonstration Services don't seem quite so lucky.

The North Bay Bohemian, a San Francisco Bay Area alt-weekly, reported in 2008 that many CDS employees received a much more limited benefits package and were paid 20 percent less per hour compared with Costco employees. The Bohemian estimated that these employees represented 10 percent of Costco’s workforce. CDS, meanwhile, has no clients other than Costco—which makes the CDS-Costco salary disparity look pretty groundless. This stain, though, does little to taint people’s conception of Costco, and all of the fun that a trip there entails.